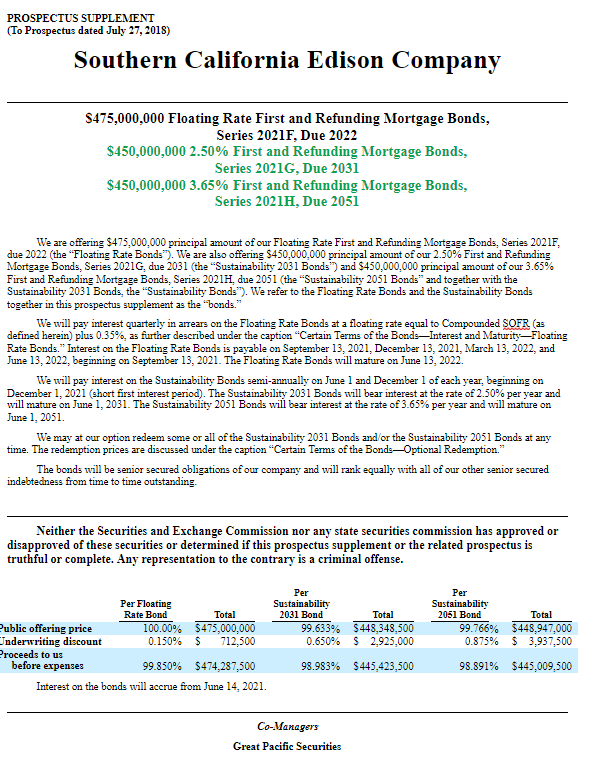

Southern California Edison has successfully raised $475 million 2.25% Floating Rate First and Refunding Mortgage Bonds, Series 2021F, Due 2022, $450 million 2.5% First and Refunding Mortgage Bonds, Series 2021G, Due 2031, $450 million 3.65% First and Refunding Mortgage Bonds, Series 2021H, Due 2051. Great Pacific Securities acted as a Co-Manager in the transaction. This is an excerpt from the original prospectus.